Do you want to know the best BIN checker API? We recommend you to read this article because here we will tell you everything about it and much more!

As the digital landscape continues to evolve, the journey forward is one of transformation and innovation. The synergy between businesses and APIs paves the way for a future where transactions are seamless, secure, and swift. With each validation, businesses forge deeper connections with their customers, establishing a bond built on trust and reliability.

Like a master detective, a Bank API dives deep into the intricate nuances of credit card digits, uncovering even the faintest trace of fraud. Its algorithms decipher the hidden messages within the digits, tracing them back to their origin with the precision of a seasoned tracker. By harnessing the power of this API, businesses transform into fortresses of security, impervious to the snares of cybercriminals.

Embracing the prowess of an API is akin to arming your business with a shield of confidence. Gone are the days of manual verifications and the incessant worry of erroneous transactions. With the finesse of a seasoned magician, this API sifts through the digital realm, identifying valid cards from a sea of possibilities. Chargebacks become a relic of the past, profits surge, and user trust is solidified.

In this symphony of technology and commerce, the Credit Card Validator – BIN Checker API plays a central role, leading the way into a world where transactions transcend mere exchanges and become expressions of seamless synergy.

Credit Card Validator – BIN Checker API

With the use of this API, you can spot fraudulent credit card transactions. Start verifying, verifying, and checking all of the information on credit/debit cards using BIN numbers. The user must send their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number) in order to access all the information.

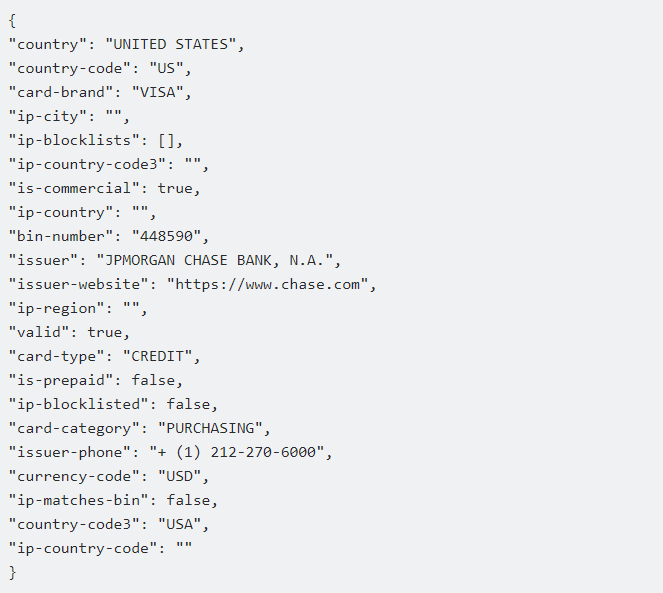

You must provide a BIN (Bank Identification Number), which is the first six digits of a credit or debit card, in order to receive the entirety of this BIN/IIN’s information in JSON format. You will be made aware of the card’s expiration date, its type—Visa or MasterCard—bank, and the place where it was issued.

All of the easily available details about the customer’s credit card will be made clear to you, including the issuing bank, the issuing institution (AMEX, VISA, MC), the location of the credit card, and whether or not it is a legitimate credit card.

The security of credit card data is upheld by using only the first six digits of the BIN. As a result, there won’t be any security flaws. This API is just utilized to confirm the legitimacy of the credit card and to get more information about the bank and the company in order to authorize the payment or make a promotion. Following the API call, this endpoint will respond to you with the following type of message:

You can watch the following video to learn how to use the API:

For those looking to add a payment gateway to their pages, this API is perfect. Because it will detect if the card is invalid, this CC Checker will be useful for those uses!