Do you want to know which BIN checker is the best? You should read this article since we will cover all about it and more in it.

In the fast-paced arena of modern commerce, where innovation is the currency of success, businesses are on a perpetual quest to leverage cutting-edge tools that propel growth. Enter the realm of using an API, an epitome of technological prowess that revolutionizes the way transactions unfold. This isn’t just a mere addition; it’s an embodiment of strategic foresight, a catalyst for expansion in a digital age.

A Bank API emerges as the sentinel of integrity, a guardian against the influx of counterfeit cards and malicious activities. Each digit pulsates with significance, and the accuracy of validation isn’t just a convenience; it’s an imperative that ensures financial sanctity.

Enhancing User Experience: The Path to Customer Satisfaction

User experience is the cornerstone of success, and here, this type of API takes center stage. Imagine a checkout process devoid of hiccups, where every keystroke ushers in a sense of assurance. This API is the architect of frictionless transactions, a conductor orchestrating a symphony of seamless interactions. Customer satisfaction soars, and loyalty blossoms in the wake of every validated transaction.

Efficiency is the heartbeat of any thriving business, and an API infuses operations with a shot of adrenaline. Gone are the days of manual verifications and cumbersome procedures. This API dances with automation, navigating the labyrinth of payment processes with finesse. The result? A well-oiled machine, where time and resources are maximized.

The Credit Card Validator – BIN Checker API is a key player in this symphony of technology and business, paving the path for a world where transactions go beyond simple exchanges to reflect seamless synergy.

Credit Card Validator – BIN Checker API

You can identify fraudulent credit card transactions by using this API. Start using BIN numbers to verify, verify, and check each and every piece of information on credit and debit cards. To access all the information, the user needs to give their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number).

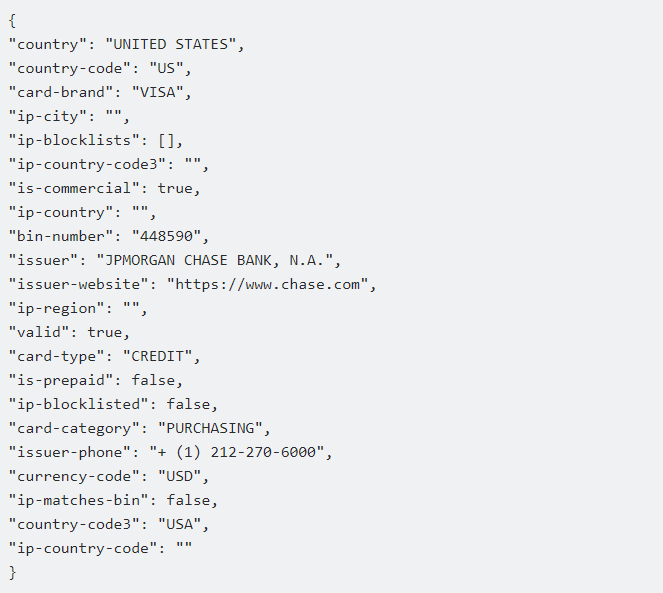

To retrieve all of this BIN/IIN’s information in JSON format, you must supply a BIN (Bank Identification Number), which is the first six digits of a credit or debit card. You will be informed of the card’s expiration date, type (Visa or MasterCard), bank, and issue location.

All of the easily available details about the customer’s credit card will be made clear to you, including the issuing bank, the issuing institution (AMEX, VISA, MC), the location of the credit card, and whether or not it is a legitimate credit card.

The security of credit card data is upheld by using only the first six digits of the BIN. As a result, there won’t be any security flaws. This API is just utilized to confirm the legitimacy of the credit card and to get more information about the bank and the company in order to authorize the payment or make a promotion. Following the API call, this endpoint will respond to you with the following type of message:

To learn how to utilize the API, watch the following video:

This API is ideal for users that want to integrate a payment gateway into their pages. This CC Checker will be helpful for those usage because it can tell if the card is invalid!