The allure of gold as a safe-haven investment has transcended centuries, making it a timeless choice for investors seeking to preserve and grow their wealth. In the modern financial landscape, Exchange-Traded Funds (ETFs) have emerged as a convenient avenue for gaining exposure to gold markets without the complexities of physical ownership. Among these options, the Goldman Sachs Physical Gold ETF stands as a prominent choice, providing investors with a direct link to the precious metal. In this article, we delve into the importance of this ETF and explore the advantages of utilizing a top-rated API for acquiring accurate and timely Goldman Sachs Physical Gold ETF rates.

Introduction to Goldman Sachs Physical Gold ETF

Physical Gold ETFs are designed to mirror the performance of gold by holding the metal in custody, effectively offering investors a way to own gold without possessing the physical asset. These ETFs are particularly appealing to those who recognize gold’s value as a store of wealth and a hedge against market volatility.

The Goldman Sachs Physical Gold ETF adds an extra layer of prestige to the realm of physical gold ETFs. With a renowned financial institution backing it, this ETF not only provides investors with exposure to gold but also carries the trust and expertise associated with Goldman Sachs. This combination of credibility and exposure to the precious metal makes it an attractive choice for investors.

Advantages of Utilizing a Top-Rated API for Goldman Sachs Physical Gold ETF Rates

Real-Time Accessibility of ETF Rates

In the fast-paced world of investments, timing is crucial. This immediacy empowers investors to make timely decisions based on the latest market data, capturing opportunities and minimizing risks associated with market fluctuations.

Accurate and Reliable Data Source

The accuracy of data directly influences the quality of investment decisions. By accessing data directly from the source, investors can confidently rely on the information to make informed choices.

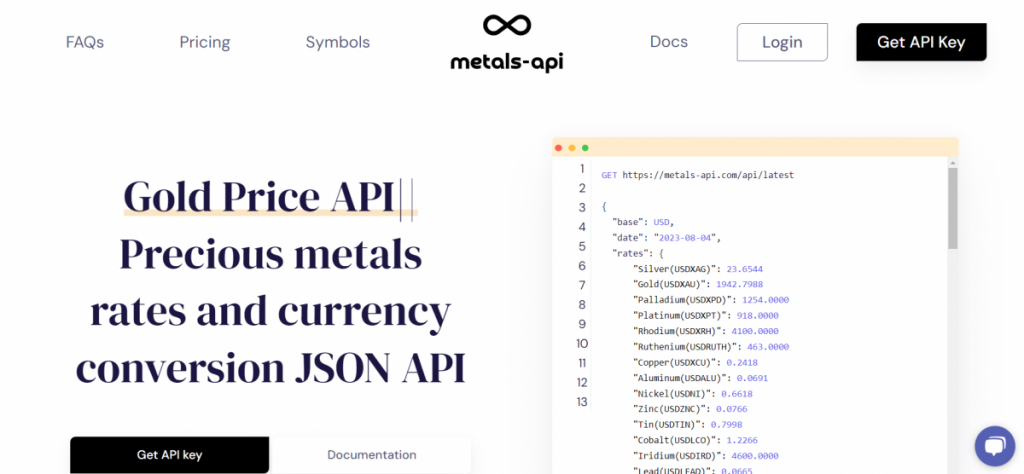

The Top-Rated API Is Metals-API!

Metals-API is a RESTful API that provides real-time and historical precious metals data. It is powered by 10+ exchange rate data sources and can deliver data at an accuracy of 2 decimal points and a frequency as high as every 60 seconds.

Metals-API offers a variety of endpoints, including:

-Current rates: Get the current price of any precious metal in any currency.

-Historical rates: Get historical prices for any precious metal in any currency.

-Exchange rates: Get the exchange rate between any two currencies.

-Conversion: Convert an amount from one currency to another.

-Time series: Get time series data for any precious metal in any currency.

-Fluctuation: Get fluctuation data for any precious metal in any currency.

-Lowest and highest price: Get the lowest and highest price for any precious metal in any currency on any given day.

Metals-API is the best API to acquire Goldman Sachs Physical Gold ETF rates. It is the most accurate and reliable API for this data, and it offers a variety of endpoints that make it easy to get the information you need. Remember to use the symbol “AAAU”.

Watch this video:

In conclusion, the Goldman Sachs Physical Gold ETF encapsulates the essence of gold investment within a regulated and convenient ETF framework. By utilizing Metals-API, investors can access real-time rates, and reliable data, and streamline their investment analyses.

Read this post: How To Obtain FT Cboe Vest Gold Target Income ETF Prices With An API