Do you want to find an API that collects information from the most trustworthy sources around the world? In this post, we’ll explain how to get it.

But first, we talk about the situation of the metals market. Industrial metals had a solid year in 2021, with the Base Metals Index climbing quickly and hitting new highs until mid-October. We expect 2022 to be favorable as well, though not as good as last year, with more differentiation between metals directly benefiting from energy transition megatrends (copper, nickel, and aluminum) and those more tied to plateauing steel production (iron ore, zinc, and coking coal), whose prices should return to more “normalized” levels this year.

As geopolitical and pandemic-related risks keep the speed of global economic recovery unpredictable, volatility should stay above average. At both the macro and local levels, we see grounds to be optimistic about industrial metals.

Global GDP growth should continue strong at a macro level, with growing industrial output and infrastructure expenditure in the United States and Europe sustaining metal demand. Given the slowing economy in China, metal consumption should be lower than last year, particularly in the real estate industry. Nonetheless, China’s supportive policies should prevent a hard landing, and the possibility of a repeat of “dual control” policies to reduce pollution and energy consumption by curtailing energy-intensive activities like steelmaking and aluminum smelting should support prices for metals whose production is being curtailed.

These changes are anticipated to maintain the supply/demand balance tight for most industrial metals, and to maintain their prices up for a prolonged period, helping to stickier high inflation. Large mining firms would gain the most in such an atmosphere.

As you can see, it is a very dynamic market and if you want to invest in any of these industries, you must be updated about the metals rates. Not only the current prices but also the historical values so you can watch the factors that influence the value of the metal that concerns you. To get this information you should use the right tools, in this case, an API.

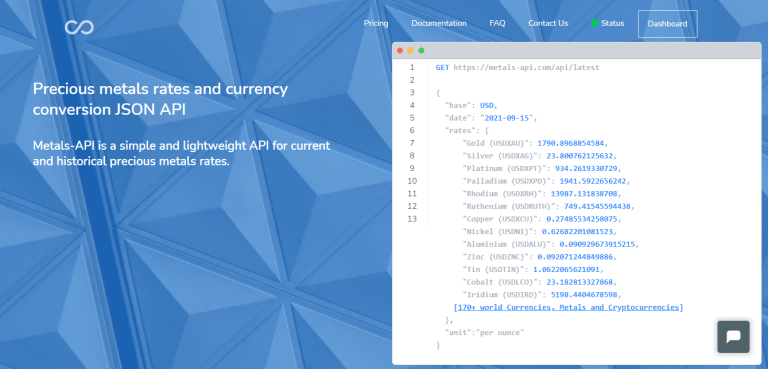

It is an Application Programming Interface that is very useful to send and gather information between multiple devices. You can use it and copy and paste it into many computer languages to design your app or site. Not every API on the internet is reliable, so you need one that collects information from very important financial entities. A CME Group rates API, that gathers data from NYMEX/COMEX, or ICE, or different markets over the world such as Uzbek Commodity Exchange or Pakistan Mercantile Exchange, and more, you should use Metals-API.

Why Metals-API?

Metals-API is software that gives you real-time metals pricing information. You can access more than 170 currencies. Regardless of whether the data is in the form of real figures or historical rates, it is accepted.

Variations in the prices may also be utilized to identify the main causes of change and the best time to buy. It includes COMEX/Nymex rates as well as information from other financial institutions. Many computer tools, including PHP, JSON, and Python, may be used to incorporate the data into your website or app.