In the fast-paced world of finance, accuracy and security are paramount. Financial institutions constantly deal with a vast array of data, including SWIFT codes and bank routing numbers, which are crucial for ensuring seamless transactions. However, manually validating this information can be time-consuming, error-prone, and leave room for potential fraud. That’s where a bank routing number verification API comes into play. This article explores the importance of such an API and why it is a must-have tool for financial institutions.

A bank routing number verification API offers a streamlined solution to validate financial information, specifically routing numbers and SWIFT codes. By integrating this powerful tool into their systems, financial institutions can automate the process of verifying these critical identifiers. This automation significantly reduces the manual effort required by staff members, allowing them to focus on more complex tasks that require human expertise.

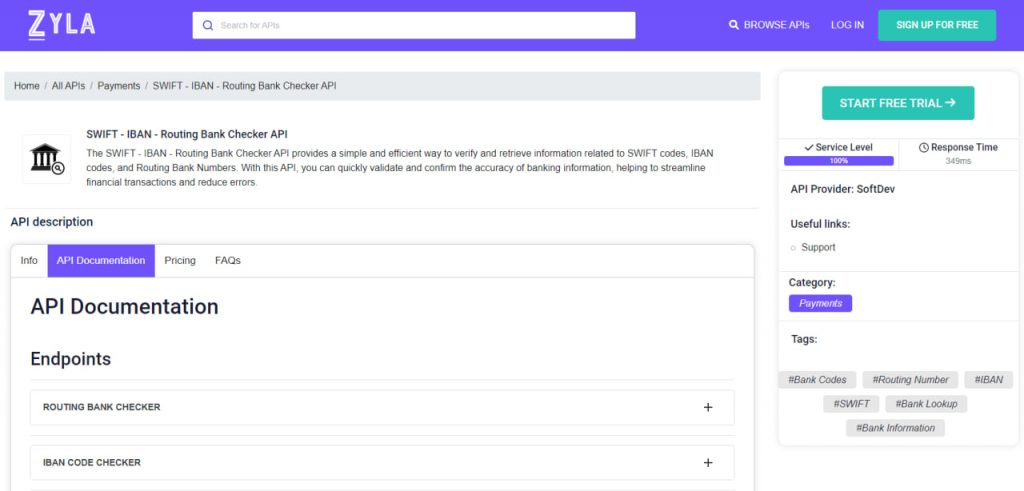

Introducing SWIFT – IBAN – Routing Bank Checker API

As the amount of data increases, so does the need for the systems capable of processing it effectively. In this particular field of finance, it’s clear that APIs are the way to go. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s a tool that is up to this challenging task. This powerful API has it’s share of applications, which we’ll describe below.

Accuracy is the backbone of any financial institution

Utilizing a bank routing number verification API such as SWIFT – IBAN – Routing Bank Checker API ensures that accurate and up-to-date information is at the fingertips of employees. The API leverages comprehensive databases and reliable sources to validate routing numbers and SWIFT codes against trusted data repositories. This verification process minimizes the risk of transaction errors, reduces the possibility of returned payments, and ultimately enhances customer satisfaction.

Compliance is a crucial aspect of the financial industry

SWIFT – IBAN – Routing Bank Checker API can assist institutions in meeting compliance requirements by ensuring accurate and valid financial information is used in all transactions. This reduces the risk of penalties, fines, and legal consequences that can arise from non-compliance.

Fraud prevention is a constant battle in the financial industry

By integrating a SWIFT – IBAN – Routing Bank Checker API, financial institutions can significantly strengthen their security measures. The API cross-references routing numbers and SWIFT codes against extensive databases to flag any suspicious or unauthorized transactions. This proactive approach helps prevent fraudulent activities, safeguarding the institution’s reputation and protecting customers’ financial assets.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API can be seamlessly integrated into existing systems and applications. It can be used to enrich CRM systems, accounting software, mobile applications, and other financial tools.

With it’s flexible integration capabilities, businesses can create a unified view of their customers’ financial landscape, allowing for a more comprehensive analysis of financial data. SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers. To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9 digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

By automating the validation process, enhancing accuracy, preventing fraud, meeting compliance requirements, and improving customer service, SWIFT – IBAN – Routing Bank Checker API empowers institutions to optimize their operations and provide a superior banking experience.

Financial institutions that embrace this technology gain a competitive edge by reducing costs, mitigating risks, and fostering trust with their customers. As the financial industry continues to evolve, the integration of a bank routing number verification API becomes an essential component for staying ahead in a rapidly changing landscape. You can try SWIFT – IBAN – Routing Bank Checker API by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.