Do you want to know why and how investment companies use APIs for obtaining commodities live rates? If so, keep reading!

You may already be aware that commodities are the raw materials used to produce the numerous consumer goods we use on a daily basis. Some of the most common commodities used today include; the flour we use to make bread, the wood we use to build furniture, and the oil and iron required to build and power the motors in our cars.

Additionally, commodities investing has a number of advantages that investors and traders find enticing. There will always be a changing need for them because their manufacturing of consumer goods and services rely on them. As a result, they constantly present investment opportunities. They are also used as a value buffer against inflation and economic instability due to their inherent value.

Commodity prices fluctuate over time for a variety of reasons, just like everything else on the market. Weather, supply and demand, and political events are a few of these. Considering that these shifting circumstances have the potential to significantly alter commodity prices, it’s critical to monitor these swings. Fortunately, there is now a simple way to monitor these changes, and that is by using an API for commodities prices.

Why Investment Companies Rely On APIs To Obtain Commodities Live Prices?

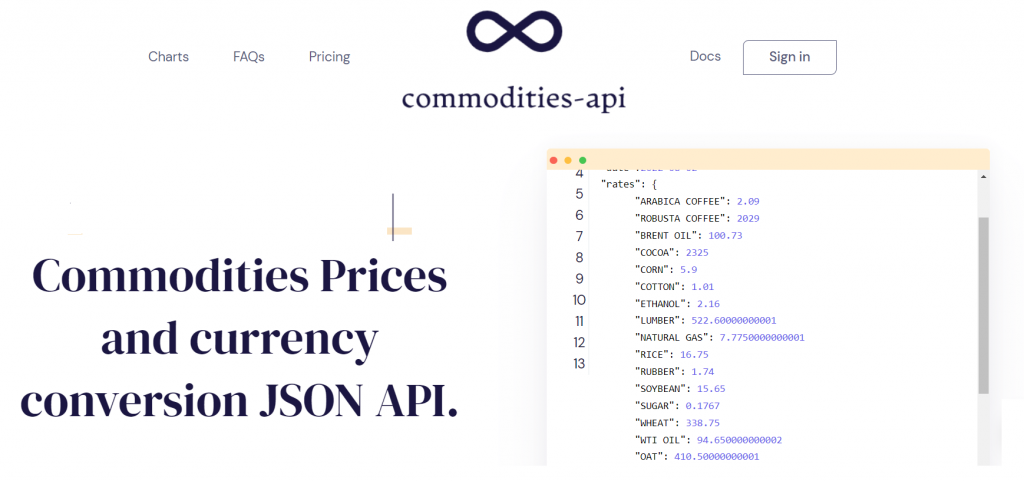

An application programming interface, or API for short, enables communication between two software programs. In this way, they can quickly request and retrieve trustworthy data. As a result, ecause it collects precise commodity data from numerous reliable sources; an API for commodities prices can quickly give you their live rates with just one API request.

Overall, using a tool like this is the best approach to access a certain piece of data; in fact that is why many companies choose to employ on APIs to obtain commodities live prices. However, you must be aware of which web site has the best API. This is because, not all the APIs readily available today offer the best capabilities.

To help you decide which API is the best for you, we suggest employing one that is reputable and has market experience. For instance, you should use Commodities-API; which is a well-known online service that collects data on commodity prices from over 15 trustworthy sources every minute; including the Central Bank, banks, and financial data companies.

How Can These Companies Use This API To Obtain Commodities Live Rates?

- Sign up at Commodities-API. You can choose the plan you want to use. The three plans that are now offered for this API are amateur, basic, and professional. Choose the one that best satisfies your requirements after weighing their differences. As an illustration, if you choose the first plan, you will get hourly commodity updates without spending a dime!

- You will receive an API key after registration; which you must use each time you make an API call. However, you must authenticate it first by including your bearing token in the authorization header before you can use it.

- To receive commodity live rates, simply select the currency in which you want to view your pricing; followed by the commodity symbol you want.

- Finally, execute the API call and await the response.

Related post: How An API Can Give You Open And Close Commodity Rates Of An Specific Day