Europe stands at the crossroads of its energy transition, and within this landscape, Natural Gas Futures Europa plays a pivotal role. Navigating this complex and dynamic market requires a deep understanding of the multifaceted potential and the challenges that come with it.

Natural Gas Futures Europa: The Landscape

Imagine Europe’s gas landscape as a winding mountain road, reaching a critical fork. On one path lies continued reliance on traditional gas futures, offering familiar yet volatile terrain. On the other, a less-traveled route beckons, paved with innovative gas futures that hold the promise of a cleaner, more secure energy future, but riddled with uncertain obstacles.

The Crossroads

- Geopolitical Tug-of-War: Europe’s dependence on gas imports, particularly from Russia, creates a precarious balancing act. While gas futures provide hedging and price discovery, they remain susceptible to geopolitical tensions, potentially sending prices spiraling and jeopardizing energy security.

- Climate Crossroads: Climate goals demand a shift away from fossil fuels, yet gas remains cheaper and more readily available than many renewables. Natural gas futures can bridge this gap in the short term, but their long-term viability hinges on integrating technologies like carbon capture and storage, making gas cleaner, and paving the way for renewables to take center stage.

- Market Volatility: The inherent volatility of gas futures can be both a boon and a bane. Investors navigate potential windfalls, but businesses and consumers face unpredictable costs, impacting economies and social welfare. Balancing risk and reward through responsible market practices and diversification is crucial.

Opportunities At The Junction:

- Investment Magnet: Innovative gas futures contracts, like those linked to carbon neutrality, can attract sustainable investments, propelling the development of cleaner gas infrastructure and renewable energy sources like biogas. This influx of capital can accelerate Europe’s energy transition.

- Innovation Engine: The dynamic nature of gas futures fosters a fertile ground for new financial instruments and trading strategies. Data-driven algorithms and AI-powered analysis can optimize risk management, improve price forecasting, and even incentivize responsible gas usage.

- Price Transparency: Robust and transparent gas futures markets provide a clear picture of supply and demand, enabling informed decision-making for investors, businesses, and policymakers. This can lead to more efficient resource allocation and better overall market stability.

Challenges On the Unfamiliar Path:

- Greenwashing Concerns: Unregulated, carbon-neutral gas futures could be mere greenwashing, masking continued reliance on fossil fuels. Rigorous standards and oversight are needed to ensure true environmental responsibility.

- Market Manipulation: The complexities of gas futures create fertile ground for potential manipulation, jeopardizing fair competition and investor trust. Regulatory frameworks and robust surveillance mechanisms are vital to maintain market integrity.

- Social Impact: Rising gas prices can disproportionately burden vulnerable populations, exacerbating existing inequalities. Policymakers must consider social safety nets and targeted interventions to ensure equitable access to affordable energy.

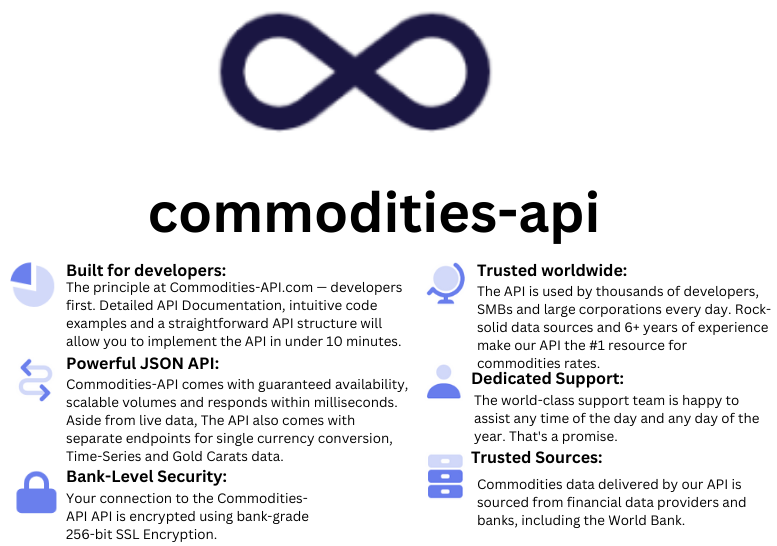

Commodities-API: Natural Gas Futures Europa

Fueled by information from over 10 exchange rate data sources, Commodities-API excels in providing up-to-the-minute data on precious commodities. The API boasts various endpoints, each designed for specific purposes. Functionalities encompass accessing the latest rates for all or specific currencies, converting amounts between currencies, retrieving Time-Series data for one or multiple currencies, and querying the API for daily fluctuation data.

Leveraging Commodities-API

- Facilitate Price Discovery Natural Gas Futures Europe to provide transparent platforms for price discovery. Investors and businesses leverage these mechanisms to make informed decisions and hedge against market volatility.

- Commodities-API integration ensures real-time data for informed investment decisions.

- The API, with its versatile endpoints, facilitates the integration of innovative solutions into trading systems.

- Commodities-API’s historical and real-time data capabilities aid in analyzing the effectiveness of this transition.

- Geopolitical Risks: Europe’s dependence on imported gas exposes the market to geopolitical tensions. Commodities-API’s robustness ensures that you stay informed about fluctuating prices indue to these events.

- Market Manipulation: Ensuring fair competition and investor protection is crucial. Commodities-API, known for its transparency, aids in mitigating risks associated with market manipulation.

- Social and Economic Disparity: Rising gas prices can impact vulnerable populations. Commodities-API’s real-time data empowers policymakers to implement measures that protect consumers and ensure equitable access to energy resources.

Natural Gas Futures Europa: Developer’s Roadmap

- Sign Up: Create an account at www.commodities-api.com and select your pricing plan.

- Explore: Navigate API documentation for endpoints, authentication, and data formats.

- Call APIs: Use programming languages to send requests with authentication tokens.

- Utilize Data: Extract JSON or XML formatted price data for integration into applications, dashboards, or analysis tools.

Example

Endpoint: Latest

- INPUT:

- Base Currency: USD

- Symbol (Code): EU-NG

- API Response:

{"data":{"success":true,"timestamp":1703945880,"date":"2024-01-01","base":"USD","rates":{"EU-NG":0.0098794704603833},"unit":{}}}Conclusion

As you embark on your exploration of Natural Gas Futures Europa, leveraging Commodities-API is not just a choice; it’s a strategic advantage. The API aligns seamlessly with the rhythm of your investments, providing real-time data and fostering excellence in your applications and trading systems. With Commodities-API, your journey into the potential of Natural Gas Futures Europa becomes not just comprehensive but also cutting-edge and technologically sophisticated.

For more information read my blog: What Is The Best API To Get European Natural Gas Futures Rates?