In the ever-evolving landscape of digital transactions, developers are faced with the critical task of ensuring tax compliance and legitimacy in international business ventures. VAT Validator APIs emerge as indispensable tools in this realm, streamlining the validation process for VAT numbers. This blog aims to guide developers through the intricacies of utilizing a VAT Validator API, including the discovery the API using the tag-based API searching approach.

Navigating The Evolving API Economy

As the API economy evolves, so do the challenges for developers in ensuring seamless transactions. VAT Validator APIs play a pivotal role in this scenario, enabling businesses to verify VAT numbers swiftly and accurately.

The Discovery Dilemma

Discovering the right VAT Validator API poses challenges, from sifting through countless options to ensuring quality, support, and seamless integration. Developers face the dilemma of shortlisting APIs that not only meet their requirements but also fit into a comprehensive ecosystem.

Solutions To The Discovery Dilemma

Tag-Based API Searching: The tag-based API searching approach proves to be a beacon in the sea of APIs. By navigating a tag section, developers can efficiently find VAT Validator APIs without wading through diverse categories. This streamlined approach ensures precision in API discovery.

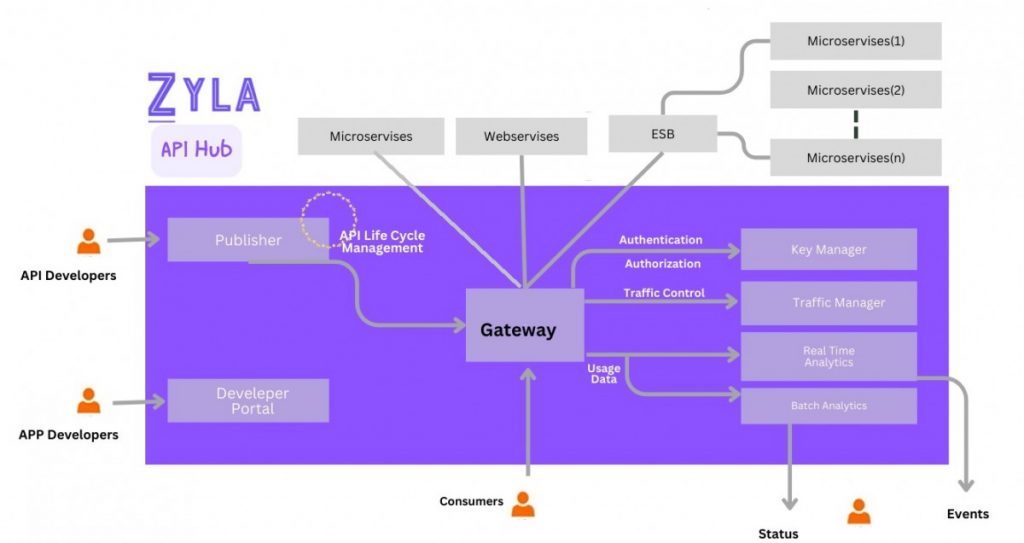

API Marketplace Confidence: Digital platforms, especially API marketplaces, offer a curated space for developers to explore and choose APIs with confidence. With API Hub’s reputation for quality, support, and seamless integration, developers can find a comprehensive ecosystem to meet their VAT validation needs.

The API Hub: A Quality Marketplace

Quality Assurance: Zyla API Hub stands as a quality API marketplace, offering reliability, security, and serviceability. The platform’s commitment to a robust support system ensures developers can integrate VAT Validator APIs with confidence.

Tag Section Exploration: Dive into Zyla API Hub’s user-friendly environment, specifically its tag section, use this section to discover VAT Validator APIs efficiently. The curated tags guide developers to a collection of APIs, ensuring a targeted search for VAT validation tools.

Leverage Zyla’s tag-based API search with ease:

- Go to zylalabs.com/tags.

- Input VAT Validator API [your desired tagged APIs] in the search bar and press enter.

- Dive into the tag page, showcasing a compilation of the Best APIs for ‘VAT Validator API’ across the hub’s diverse categories.

Present a curated list of VAT Validator APIs available on Zyla API Hub, showcasing their key features, pricing, and trial options. This list serves as a starting point for developers to explore potential contenders.

List Of VAT Validator APIs

Top-rated VAT Validator APIs:

- 💳 VATValidator API: Swiftly confirms VAT numbers, ensuring tax compliance. Enjoy a free 7-day trial.

- 🌐 VAT Validation API: Quickly determines VAT number validity, with additional company insights. Free 7-day trial available.

- 🔄 Validate VAT Number API: Fast solution for VAT validation, seamlessly integrating with EU countries. Free 7-day trial.

- 📊 VAT Checker API: Verify European Union VAT numbers, retrieve detailed company info. Free 7-day trial included

Selecting And Evaluating

Assessing APIs for the Ideal Choice? Review the selected contenders according to your application’s needs, taking into account factors such as accuracy, speed, and integration simplicity by:

- Delve into Documentation: Examine the documentation of the chosen APIs. A comprehensive grasp of their features and endpoints is crucial for seamless integration.

- Trial and Assessment: Make use of trial options to assess the APIs in real-world situations. Evaluate their compatibility with your application’s objectives through hands-on testing.

- Community and Assistance: Scrutinize the API’s community engagement and support framework. A resilient support system ensures a smooth integration process.

Conclusion

In conclusion, mastering the utilization of VAT Validator APIs involves strategic discovery, leveraging tag-based searching, and exploring reputable API marketplaces like Zyla API Hub. Developers can navigate the evolving API landscape with confidence, ensuring seamless and compliant transactions.

For more information read my blog: How To Secure Your Wire Transfers With A Bank Information API