Predicting the trajectory of the Corn Mar 2024 market involves navigating a complex landscape of variables. To comprehend the potential directions, we delve into the intricacies influencing corn prices, shedding light on the role of global demand, weather patterns, geopolitical tensions, increased production, economic factors, and government interventions. In this blog, we will be highlighting features of commodity APIs that can help us in this prediction.

Factors At Play

- Global Demand: As China, the largest corn importer, amplifies its purchases driven by rising pork production and biofuel demands, global corn demand is set to surge.

- Weather Patterns: Dry conditions in key corn-growing regions, particularly the US Midwest, may lead to lower yields and tighter supplies, adding an element of uncertainty to the market.

- Geopolitical Tensions: The ongoing war in Ukraine disrupts global food supply chains, putting upward pressure on corn prices as the market reacts to geopolitical uncertainties.

- Increased Production: Brazil, the world’s second-largest corn producer, anticipates a rebound in output, potentially counteracting some upward price pressures.

- Economic Factors: A potential global economic slowdown could dampen demand for corn, especially in the biofuel sector, introducing a mitigating factor to price movements.

- Government Interventions: Some governments may implement measures to regulate domestic corn supplies or curb exports, influencing international prices.

Commodities-API: Navigating The Corn Mar 2024 Market

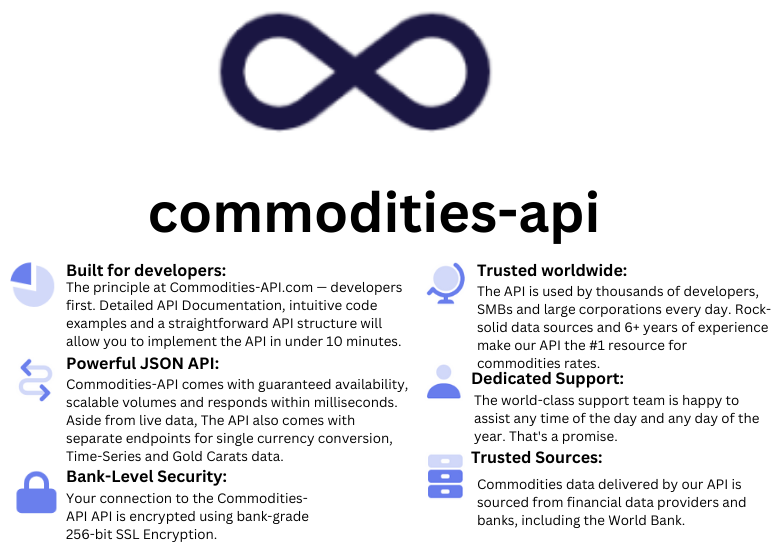

In the face of these complexities, stakeholders need real-time insights and accurate data to make informed decisions. This is where commodities API emerges as a powerful solution. By providing millisecond response times, scalable volumes, and reliable availability, the API equips users with the tools to navigate the dynamic corn market.

Key Features Of Commodities-API:

- Real-Time Data: Commodities-API ensures timely access to the latest market data. Allowing stakeholders to stay ahead of fluctuations in Corn Mar 2024 prices.

- Endpoint Versatility: With separate endpoints for converting currencies and retrieving time-series data. The API caters to diverse user needs, enhancing its usability.

- Structured Documentation: The API’s well-defined structure, accompanied by understandable code samples and comprehensive documentation. Facilitating quick and easy implementation in less than ten minutes.

Getting Started With Commodities-API

- Register: Begin by registering on Commodities-API through the provided link.

- Explore API Endpoints: Utilize the search parameters and symbols offered by the API to find the exact endpoints suited to your requirements.

- Initiate API Requests: Click “run” after reaching the required endpoint to initiate the API request and view the results on-screen.

Example

Endpoint: Latest [request the most recent commodities rates data] – Corn Mar 2024

- INPUT

- Base Currency: USD

- Symbols (Code): CH24

- API Response:

{"data":{"success":true,"timestamp":1703591100,"date":"2023-12-26","base":"USD","rates":{"CH24":0.0021152829190904},"unit":{}}}Conclusion

As we navigate the uncertainties of the Corn Mar 2024 market. Commodities-API stands as a beacon, offering precise data delivery for strategic decision-making. Stakeholders can leverage the API to optimize their activities and achieve favorable results. Making it a cornerstone in the journey toward sustained success in the dynamic corn trading market of March 2024 and beyond. Embracing technological advancements through Commodities-API ensures a competitive edge in the ever-evolving landscape of commodity trading.

For more information read my blog: Coal Prices API: A Comprehensive Guide To 2024