Do you need daily access to Metals Prices to work with? Learn how to stay current easily by reading this article.

Base metals, such as iron ore, copper, aluminum, and nickel, are the lifeblood of global industrial production and construction. They are also a valuable weather vane indicator of changes in the global economy, driven by the vagaries of supply and demand.

There is no doubt about the prevailing direction of the winds that drove the metals in recent years. Prices have gradually declined since 2011. Although the price of oil has also fallen, the decline is more recent and more abrupt. In both cases, however, the downward pressure on prices is generally the result of abundant production during high prices.

With iron ore demand shaken by falling Chinese consumption and the European energy crisis, analysts reveal their expectations for metal commodity markets in the coming months:

1. The combination of weakening demand from China and the prospect of a global economic recession has negatively impacted iron ore price performance this year.

2. The outlook for the iron ore market in short to medium term remains volatile due to significant structural challenges in the Chinese property sector.As well the energy crisis in Europe, slowing global growth, a generalized rise in inflation, and problems in supply chains around the world.

3. European steel production will decline this quarter. This is because, with falling demand and high input costs, production plant margins will be squeezed further in the coming months, as shown by the Purchasing Managers’ Index (PMI).

Global conflicts have had a significant impact on the metals market. If we examine, for example, the price development of these raw materials since the start of the war in Ukraine, we see that nickel, aluminum, and copper have been the hardest hit. And the price of iron ore has plummeted by 33% since then.

However, while there is no doubt that the nickel price shock was directly caused by the Russian invasion of Ukraine, the same cannot be said for iron ore, which has devalued due to lower demand from China.

Use An API

The metals market is a market characterized by its volatility. The complexity of the world situation, of the industrial processes that drive the exchange of metals, and the climatic conditions that allow their extraction, are factors that permanently influence the metals market.

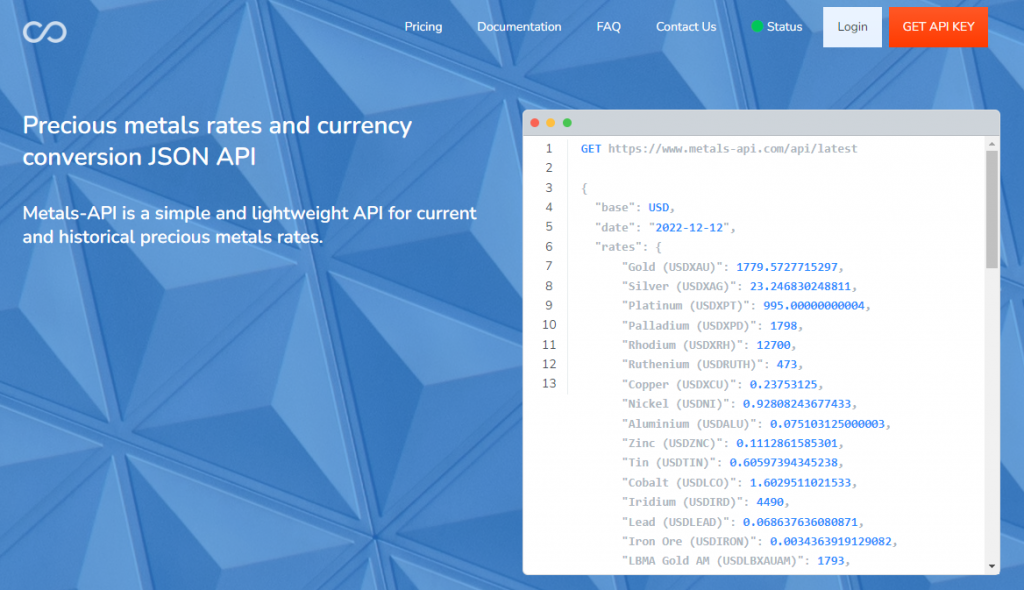

The extraction and commercialization of metals also affect the production chain and the world situation, which is why it is of global importance. That is why if you have a related business, you must know the market’s state and its prices. There is a way to do it to save time and money. We recommend Metals-API to find prices from anywhere in the world. An API response type would look like this:

Why Metals-API?

Metals-API is a professional tool preferred by most programmers. It allows you to integrate information in a wide variety of programming languages such as JSON, JQuery, PHP, Curl, or Python among many others.

You will be able to integrate into your website or platform information from the most important financial markets in the world such as World Bank and LBMA. In addition, you can be confident that you will always have metal data updated in real time, and you can choose the currency in which you want it to be displayed.

Another important aspect is that with this API you will be able to compare current information with historical information about changes in values.Check this now in https://www.metals-api.com