Are you an investor in precious metals? Expand your business through a metals rates API!

The known chemical elements of the planet are represented by the periodic table, and some of them are wise investments. Rare earth metals and a group of substances referred to as base and precious metals provide a variety of trading possibilities to today’s investors and active traders. They are frequently shaped into ingots for use in physical transactions.

Base metals are metals that quickly oxidize or corrode, according to chemistry. Copper (Cu on the periodic table), nickel (Ni), aluminum (Al), zinc (Zn), lead (Pb), tin (Sn), and iron (Fe)/steel are among these industrial metals (an alloy of iron and carbon).

Metals are often in great supply and have a wide range of industrial and commercial uses. These utilize steel used in the manufacture of automobiles, aluminum cans, and copper piping. Base metal prices are significantly lower than those of precious and rare earth metals due to their availability. The demand for the goods for which the metals are used affects how much they cost.

There are several avenues for traders and investors to get involved in the base metals market. Investments can be made in specific businesses that produce certain basic metals, such as the steel producer U.S. Steel (X) or the aluminum producer Alcoa (AA). Individual metal futures and options contracts, such as copper futures (HG) and options (HX), can be traded on CME Globex.

Natural metallic chemical elements with a high melting point and luster are known as precious metals. They are less reactive than other elements and are softer and more ductile than other metals. Precious metals are expensive because they are rare. They are used in the production of jewelry, works of art, coinage, dental work, electronics, and financial investments.

Those interested in the precious metals markets have access to a wide selection of investment vehicles, much like those for base metals. Long regarded as a reliable investment, gold is frequently kept physically as jewelry, coins, or gold bars. Gold is increasingly popular as a last-resort asset, especially amid economic turbulence. In addition to owning precious metals physically, investors can trade stocks, futures, options, mutual funds and EFTs. Only online systems like Metals-API that can keep you informed of all the shifting movements of precious metals allow you to conduct these kinds of transactions appropriately.

What Is Metals-API?

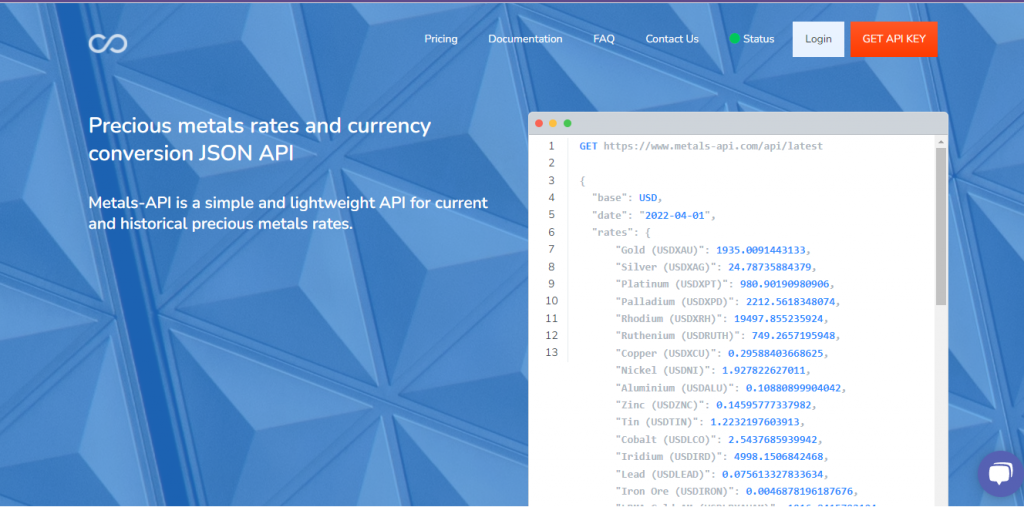

When Metals-API was launched, it was a straightforward, lightweight API for banks’ current and historical precious metals prices. The Metals-API API may deliver real-time precious metals data through API at a frequency as high as every 60 seconds, with an accuracy of two decimal places. Providing exchange rates for precious metals, currency conversions, time-series data, volatility statistics, and the lowest and highest prices of any particular day are a few of the features.

How Does It Work?

Metals-API it´s really simple and easy to use. All that’s left for you to do is follow these instructions:

- Create a profile on the website.

- Achieve an API Key

- Next, decide the metal and currency you’ll use on the dashboard.

- Send an API request to the dashboard.

- Wait for the system to provide an API Response before using it.

Which Precious Metals And Currencies Are Supported?

Including digital currencies and other well-known currencies, the Metals-API API can give exact exchange rate data for precious metals in 170 different world funds.

Where Can I Find The Financial Data’s Sources?

Every minute, data on exchange rates is gathered by the Metals-API API from more than 15 reliable data sources. Sources include banks and businesses that provide financial data, such the European Bank.