The complexities of analyzing Natural Gas Futures Europa are multifaceted. Here we explore how technology, particularly Application Programming Interfaces (APIs), aids data scientists and analysts retrieve reliable price data for integration into Apps, Trading Systems, and analytical tools.

Key Factors In Analysis

Delving into the analysis of Natural Gas futures involves considering key factors, each playing a pivotal role in understanding market dynamics:

Fundamental Analysis

- Supply and Demand: This is the cornerstone of any commodity analysis. Track Europe’s natural gas production, LNG imports, pipeline flows, and storage levels. Analyze factors influencing demand, such as industrial activity, power generation, and heating needs. Consider the impact of weather patterns on both supply and demand.

- Geopolitical Landscape: Events in gas-producing countries like Russia, Norway, and Algeria can significantly affect prices. Monitor political tensions, sanctions, and infrastructure disruptions that could impact supply.

- Global Gas Market: Europe’s gas market is interconnected with the global market. Track LNG prices and flows in other regions, particularly Asia and North America, to understand the potential competition for supplies.

- Economic Factors: Monitor economic indicators like GDP growth, inflation, and interest rates in Europe, as they can influence energy demand and prices.

Technical Analysis

- Charting and Trend Analysis: Utilize technical indicators and chart patterns to identify historical trends, support and resistance levels, and potential breakout points.

- Volume Analysis: Monitor trading volume to gauge market sentiment and identify potential turning points.

- Market Sentiment: Stay informed about analyst reports, news articles, and market chatter to understand prevailing investor sentiment towards European gas futures.

Challenges In Data Retrieval

Data analysts face challenges accessing reliable, accurate, and timely historical, time-series, and fluctuating data. Natural Gas Futures Europa APIs emerge as solutions, empowering analysts to overcome these challenges and elevate the precision of their analytical systems.

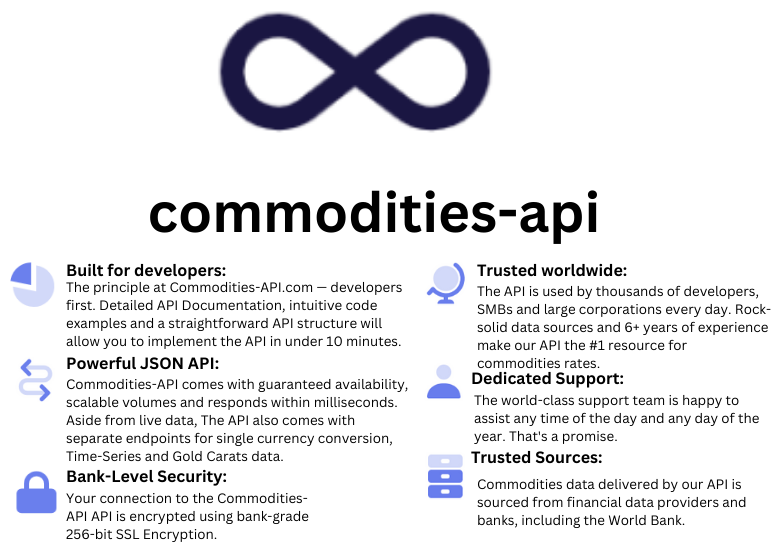

Commodities-API: A Closer Look

Turning our attention to Commodities-API, it stands out as a premier solution for analyzing Natural Gas Futures Europa. Let us explore the API’s capabilities in providing reliable, accurate, and up-to-date data. The focus is on its support for historical, time-series, and fluctuation price data, catering to the nuanced needs of developers and analysts.

Why Choose Commodities-API?

The outstanding features that make Commodities-API the preferred choice:

- Five Comprehensive Endpoints:

- Latest: Obtain the most recent commodity rates data.

- Historical: Access historical price archives for in-depth trend analysis.

- Convert: Convert commodity prices to various global currencies.

- Time-Series: Retrieve time-series data for nuanced insights.

- Fluctuation: Monitor price changes with real-time fluctuation data.

- Ease of Integration:

- Seamlessly integrates into various systems.

- The straightforward integration process ensures quick harnessing of real-time Natural Gas Futures data.

- Technical Allure for Developers:

- Catering to developer needs, the API offers impeccable technical features.

- The API responds in widely accepted formats like JSON or XML, ensuring versatility and adaptability to different programming languages.

- This flexibility allows developers to extract and integrate price data effortlessly into their applications.

- Support System Confidence:

- Developing Apps or Trading Systems demands a reliable support system, and Commodities-API delivers.

- The platform provides a robust support system, adding a layer of confidence for developers and users.

- Whether clarifying doubts, resolving issues, or offering guidance on optimal API utilization, the support system ensures a smooth and reassuring experience.

- User-Friendly Documentation:

- To facilitate easy onboarding, the API offers comprehensive documentation.

- This resource serves as a guide, providing insights into endpoint URLs, authentication methods, and data formats.

- Users can find code examples for various programming languages, streamlining the integration process.

Guide To Using Commodities-API

A step-by-step guide for developers:

- Signing Up: Creating an account and choosing the appropriate pricing plan.

- Familiarization: Navigating the API documentation for endpoint URLs, authentication methods, and data formats.

- Making API Calls: Utilizing programming languages or tools to send requests, including necessary authentication tokens.

- Using Data: Extracting relevant price data in JSON or XML format and seamlessly integrating it into applications, dashboards, or analysis tools.

Example

Endpoint: Latest

- INPUT:

- Base Currency: USD

- Symbol (Code): EU-NG

- API Response:

{"data":{"success":true,"timestamp":1703945880,"date":"2024-01-01","base":"USD","rates":{"EU-NG":0.0098794704603833},"unit":{}}}Conclusion

To sum up, Commodities-API, represented by the symbol EU-NG, effectively navigates the intricacies of the Natural Gas Futures Europa Market. Developers and analysts can confidently explore Europa Natural Gas Futures data, leveraging precise information for accurate analyses and informed decision-making. This fosters excellence in their applications and trading systems.

For more information read my blog: European Natural Gas Futures: What Is The Best API With Up To Date Prices?