The global energy landscape is dynamic, with natural gas playing a pivotal role, constituting 23% of the market. In the European context, Natural Gas Futures Europa takes center stage, attracting traders, customers, and consumers keen on understanding and leveraging the complexities of its fluctuating prices. The dynamics of the European Natural Gas Futures Market are intricate, and staying informed about real-time price changes is paramount for successful trading and decision-making.

Challenges In Monitoring Natural Gas Futures Prices

Fluctuations in Natural Gas prices are influenced by various factors, including global demand, geopolitical events, and economic trends. Traders and stakeholders face the challenge of retrieving reliable, accurate, and real-time prices to navigate this complex market effectively. This need for precision has led to the emergence of Application Programming Interfaces (APIs), specifically tailored for Natural Gas Futures Europa.

The Role Of Natural Gas Futures Europa APIs

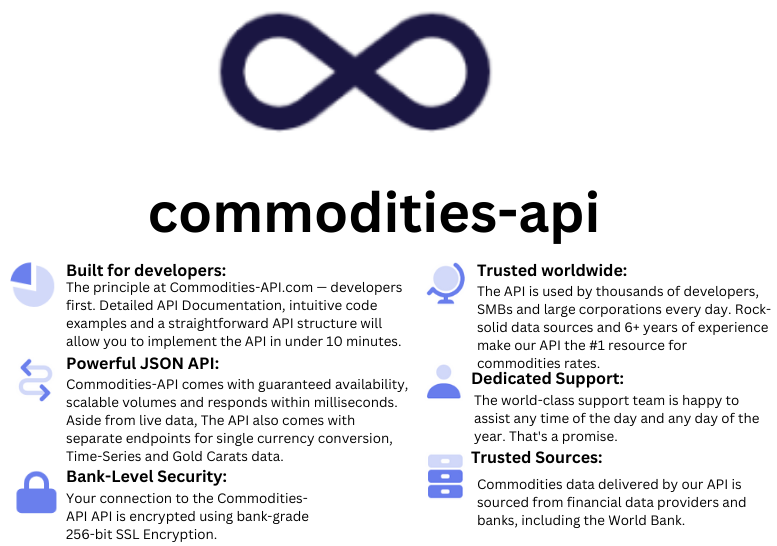

Natural Gas Futures Europa APIs provide a robust solution for real-time monitoring of prices in the European market. These APIs offer a gateway for developers and stakeholders to access accurate and up-to-date information crucial for making informed decisions. The focus shifts to Commodities-API, a standout solution for individuals and organizations developing applications or trading systems in the realm of Natural Gas Futures.

Why Choose Commodities-API?

- Five Key Endpoints: Commodities-API offers five main API endpoints, covering the Latest rates, Historical data, Conversion rates, Time-series data, and Fluctuation data. This comprehensive coverage ensures users have access to a wide range of valuable information.

- Ease of Integration: Developers find Commodities-API user-friendly, with detailed documentation and intuitive code examples. Integration into existing systems becomes seamless, enabling quick implementation in under 10 minutes.

- Technical Features: The platform boasts a powerful JSON API with guaranteed availability, scalable volumes, and fast response times. Security is prioritized, employing bank-grade 256-bit SSL encryption to ensure a secure connection.

- Dedicated Support: Commodities-API stands out with its world-class support team, available around the clock. Assistance is provided promptly, ensuring a smooth experience for users.

- Trusted Worldwide: Utilized by thousands of developers, SMBs, and large corporations globally, Commodities-API sources data from reputable financial data providers and banks, including the World Bank.

How To Use Commodities-API For European Natural Gas Rates

- Signing Up:

- Visit the Commodities-API website and create an account.

- Choose an appropriate pricing plan after exploring the available options.

- Familiarize Yourself:

- Dive into the API documentation, understanding endpoint URLs, authentication methods, and data formats.

- Explore code examples for various programming languages provided in the documentation.

- Making API Calls:

- Use your chosen programming language or tools to send API requests to specified endpoint URLs.

- Include authentication tokens or parameters in your requests.

- Using Data:

- The API response will typically be in JSON or XML format.

- Utilize parsing capabilities in your chosen language to extract relevant price data.

- Integrate the data into your applications, dashboards, or analysis tools.

Example

Let’s take a snapshot using the Latest API endpoint:

- INPUT:

- Base Currency: USD

- Symbol (Code): EU-NG

- API Response:

{"data":{"success":true,"timestamp":1703945880,"date":"2023-12-30","base":"USD","rates":{"EU-NG":0.0098794704603833},"unit":{}}}This instant access to Natural Gas Futures Europa rates encapsulates the essence of Commodities-API’s commitment to providing the best tools for traders.

Conclusion

In conclusion, navigating the European Natural Gas Futures Market requires a reliable source of real-time data. Commodities-API, with its tailored Natural Gas Futures Europa support, emerges as a go-to solution for developers and stakeholders, offering a comprehensive suite of features and ease of integration.

For more information read my blog: Which API To Use To Obtain European Natural Gas Futures Prices In 2024?