For the last few years, people in Germany have been investing in precious metals. That is to say, german individuals own bars and coins on a higher percentage than, for instance, golden jewelry.

For instance, some metals like Gold were in high demand during 2020. The desire for value retention, inflation protection, and the intention to hold a real value in hand, all drive up gold demand and put it in front of other types of investments.

In comparison to other European citizens, the german population prefers to bet on gold. To clarify, more than two-thirds of Germans own at least some gold jewelry.

Even in times of crisis, the precious metal never totally loses its value, despite price swings. Gold, on the other hand, pays no interest or dividends.

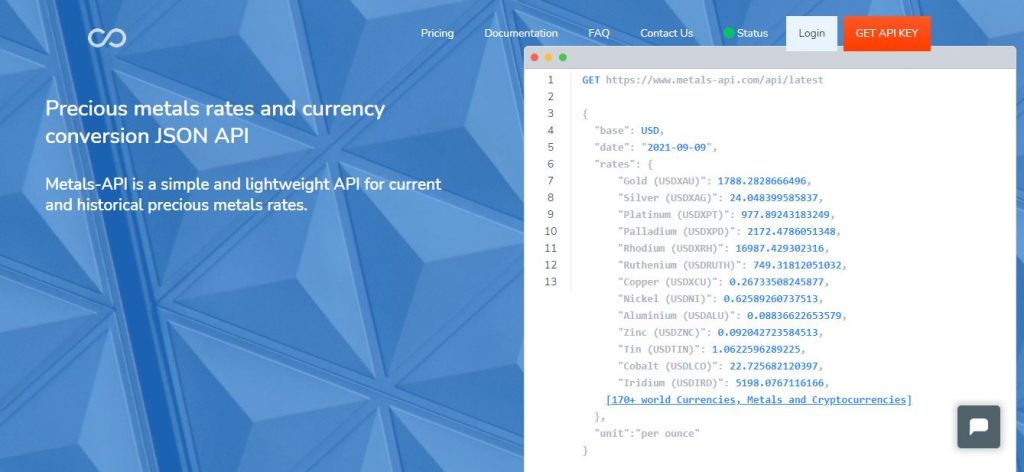

Subsequently, if you are considering investing in gold, silver, palladium, platinum, or any other precious metal, there’s a Free API at Metals-api.com

Metals-API.com provides API access to live precious metals market data with a 2 decimal point accuracy and a minutely refresh rate.

Metals-API’s main benefits

- This reliable API is used by hundreds of companies in the sector to obtain institutional-quality real-time precious metal pricing.

- With minimal effort, you can include real-time Gold and other metal values into your spreadsheets, websites, mobile apps, and other business applications.

- Reduce the time it takes for apps that rely on precious metal prices to reach the market.

- Using cloud APIs, you may bypass the problems and complications connected with legacy feeds.

Key Features

API with historical, real-time, and instant data: Real-time prices for precious and basic metals in a variety of currencies

Charts from the past and present: Gold, silver, palladium, and platinum spot and predicted prices across time

Metals-API collects market data prices from a number of trade sources and global institutions, with varying types and frequency. Commercial sources are given a higher weighting because they more accurately reflect market exchange, especially for major currencies and metals.