Nowadays, metal investment is a war shelter in front of the international situation. The metal market increases and will be easy for you if you use the best resources. In this sense, here we propose an API to get this aim.

Given the decline in stock markets, the rise in inflation, and the worsening of the global economy, the Russian invasion of Ukraine has once again made precious metals the asset of choice for investors who wish to secure their money. Since this situation, certain gold and silver vendors have claimed increases in sales of precious metals of more than 200%.

Gold and silver are resuming their historical function as assets that can be safely stored away during the war and other emergencies. The war has weakened the world economy and driven up the cost of essential goods like metals. This circumstance that raises inflation rates and endangers economic expansion.

Gold Situation

Experts claim that the current state of affairs is luring investors from all over the world to secure investments like gold. Its price has risen dramatically this year and reached $2,070.44 an ounce. In the summer of 2020, a level quite similar to that experienced during the epidemic.

The cost of metal has increased by approximately 10% so far this year. This is due to the substantial increase in demand for gold as a savings asset in Europe. This surge in demand follows a year that saw unusually high demand for the physical metal from Western nations. In this regard, 1,124 tons of gold bars and coins were demanded last year. The most in the previous ten years. This demand has helped to drive up the price of the metal.

Various Metals

In the meantime, the price of palladium increased by more than 7% to $2,665.99 an ounce, the highest amount since August of last year. Since Russia is a significant source of metal, the rise in the price of palladium is only logical. The possibility of a recession, particularly in Europe and Germany, which is a major auto producer, is the only factor that could counteract it.

Russia is third in the world for gold production, and Nornickel, situated in Moscow, is a significant palladium and platinum producer. Silver rose 4.2% to $25.56 per ounce and platinum rose 2.7% to $1,121.10, among other precious metals.

Enter Into Metal Investment

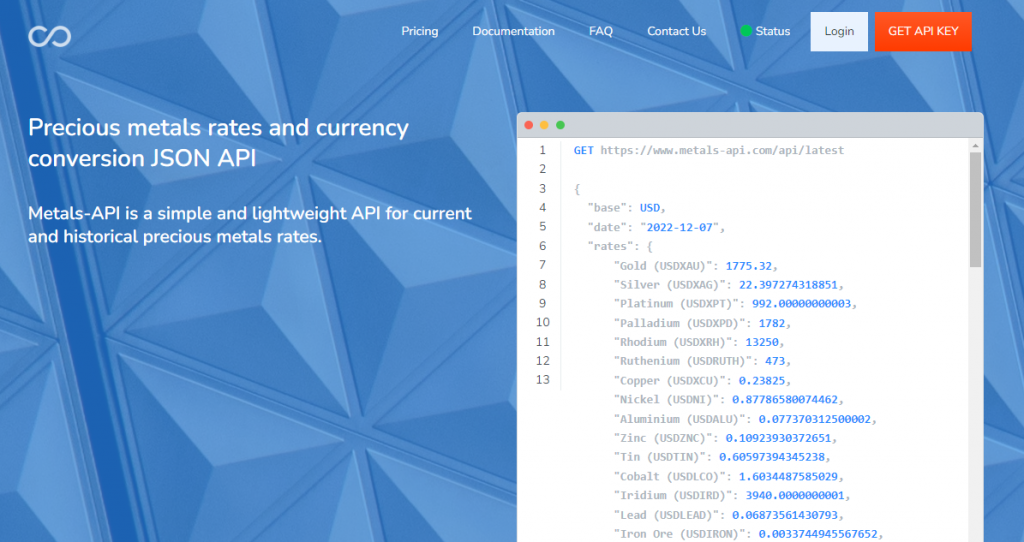

Given this complex scenario, it is best to have the appropriate resources to become an expert in the metals business. Here we want to help you with an API that, given its characteristics, will be able to update moment by moment with the prices of hundreds of metals.

Thanks to Metals-API, for example, you will be able to take into account all the factors that influence the metal industry. You will be able to collect a significant amount of data and make the best evaluations and reports. This can also help you as an investor, but you can also help other investors and economists who specialize in the subject.

About Metals-API

Metals-API provides real-time prices for various metals as well as historical prices and fluctuation data. These data are key if you want to enter the global metals business and invest at the moment or with future contracts.

It is also super easy to integrate since it can be incorporated into websites and apps with various programming languages. This is very useful if you want to design platforms that advise investors from all over the world. This API for this reason will make your metal business grow!